In this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

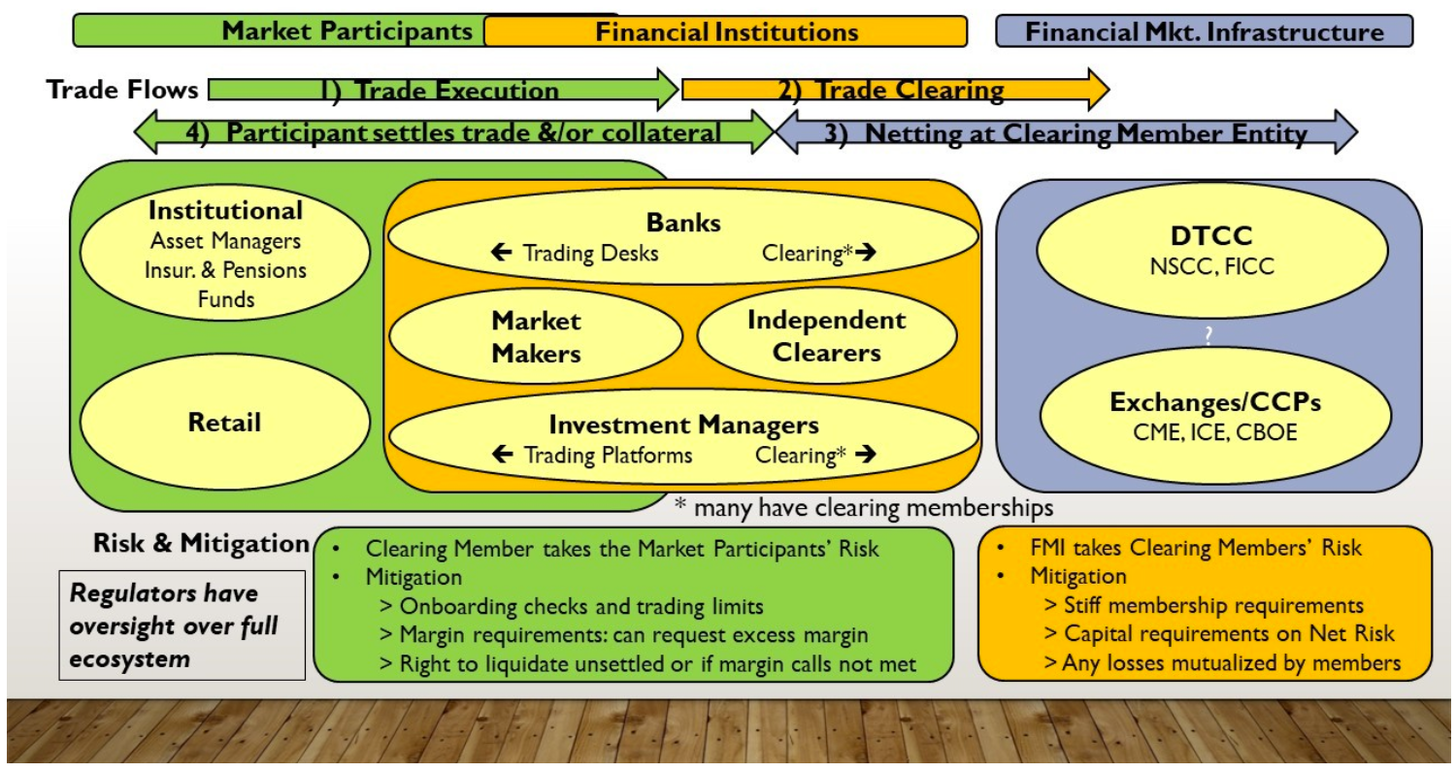

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

Read More