I examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

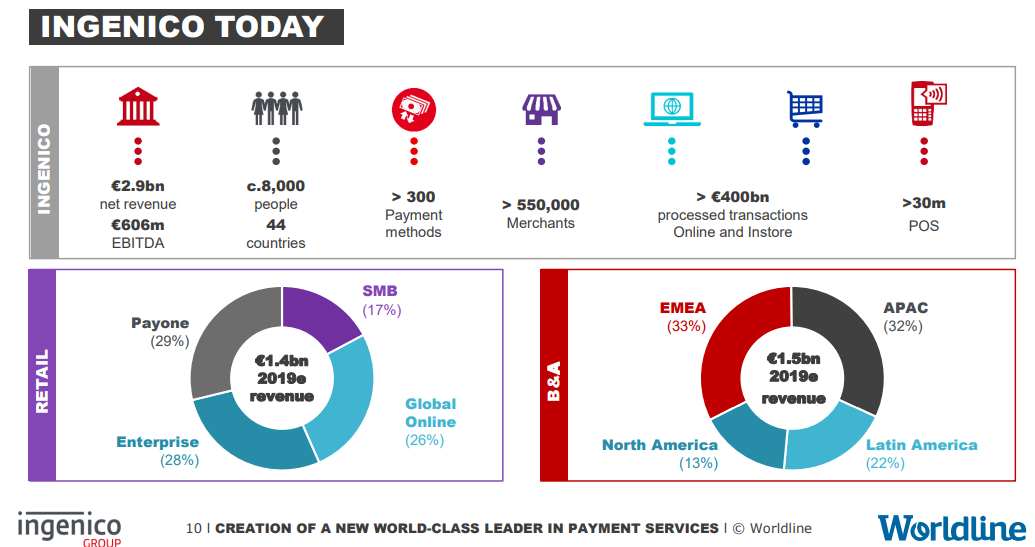

Read MoreI look at how spending $8 billion can either buy you $3 billion of revenue from Ingenico, or the private valuation of Robinhood and/or Revolut. Would you rather have a massive cash-flow machine, or a venture bet on a Millennial investing meme? To articulate this question in more detail, we walk through the impact behavioral finance has had on economic rational actor theories, and why quantitative financial modeling often similarly fails to capture the underlying tectonic plates of industry. It may not be wrong to bet on Millennials. We talk about what identity economics (ala identity politics) means for market value and how to think about generational change.

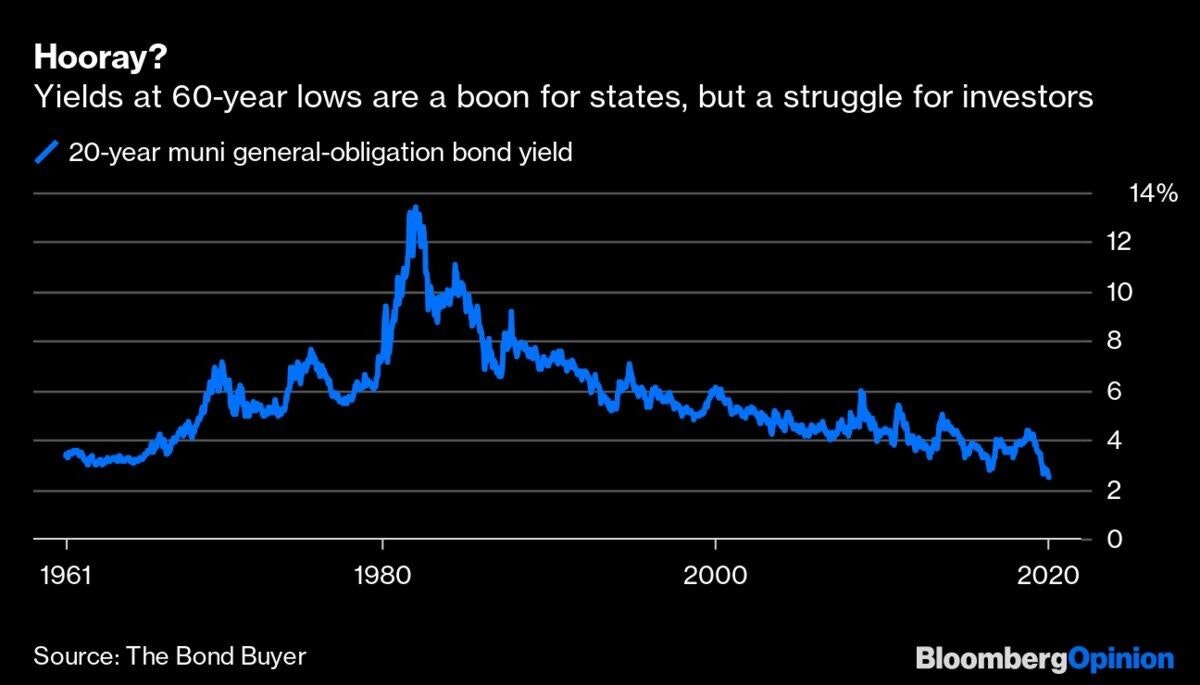

Read MoreI reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

Read MoreI discuss Citi's roboadvisor launch and why it took the firm 12 years to get to the party. We break down the difference between financial services ingredients and the organizations that combine those ingredients to manufacture and distribute financial products. We also look at how that consumer prerogative is defining the asset management industry, and the consolidation towards monolithic passive indexing providers. Last, we talk about how people prefer mass produced Twinkies to expensive artisanal desserts. Yummy!

Read More